ArunAntonio

01-03 03:33 PM

Test

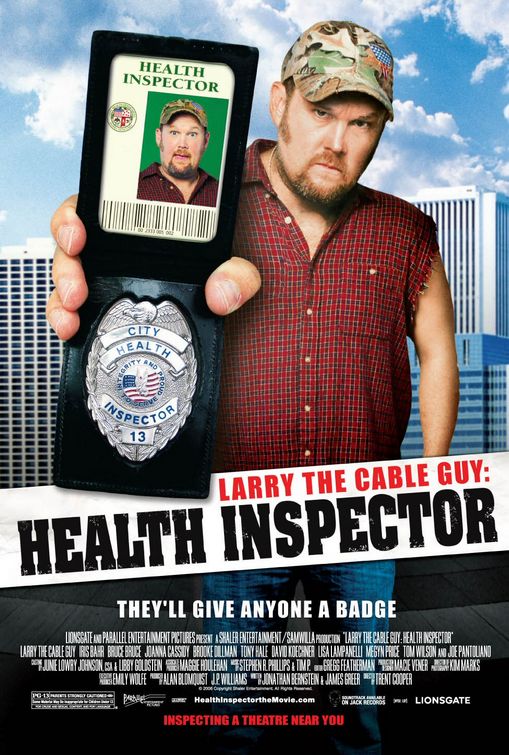

wallpaper larry cable guy. where is

dval_dpal

12-11 08:03 PM

i have seen so many people got approved from wells fargo on 485 pending stage???

i'm in same problem if somebody can light on this.....

Is 485 application notice and Ead plus I 140 will be enought for Refinance from well fargo?

i have current mortgage with well fargo and i'm trying to do refinance after 4 years with good credit history with no payment missed in last 4 years.

any help would be really helpful to talk with wells fargo

thank you

i'm in same problem if somebody can light on this.....

Is 485 application notice and Ead plus I 140 will be enought for Refinance from well fargo?

i have current mortgage with well fargo and i'm trying to do refinance after 4 years with good credit history with no payment missed in last 4 years.

any help would be really helpful to talk with wells fargo

thank you

komaragiri

08-02 04:26 PM

i am a 2nd july filer, my cheques were cashed today. filed at nebraska

Congrats !! Hopefully we all get some good news before the weekend !

Congrats !! Hopefully we all get some good news before the weekend !

2011 larry the cable guy wiki

lg72

07-24 10:18 PM

fairboy and friends,

Could you please tell me how to check an ad on the AJE website? Can I check the ad for my case using my case number? My case is stuck in DBEC.

Thanks for your help.

Could you please tell me how to check an ad on the AJE website? Can I check the ad for my case using my case number? My case is stuck in DBEC.

Thanks for your help.

more...

gc_maine2

04-04 10:27 AM

:confused::confused:

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

gc_check

07-11 12:28 PM

Hi,

My wife is on H4 and she has her H4 extension approval. But the local DMV says that they need to see a visa stamp in her passport to issue a DL. Its actually exchanging her out of state DL! Can anyone from NC (Raleigh, Cary, RTP, Durham etc) share their experiences please.

This was introduced very recently and unfortunately they are asking for a VISA Stamp in Passport. Earlier they were not issuing the DL without an ITIN if you do not have SSN; my wife had to wait for almost a year as you cannot apply for ITIN unless you send the W7 with your tax returns due to new regulations. Now they are NOT concerned on ITIN, but are looking for VISA stamp. Only thing that can be done online in NC with regards to DL is you can get a Duplicate DL online if lost or your address is changed. Try writing to Congressman David Price and see if you can get assist from him. I know this office has helped folks here on Visas before for other issues.

My wife is on H4 and she has her H4 extension approval. But the local DMV says that they need to see a visa stamp in her passport to issue a DL. Its actually exchanging her out of state DL! Can anyone from NC (Raleigh, Cary, RTP, Durham etc) share their experiences please.

This was introduced very recently and unfortunately they are asking for a VISA Stamp in Passport. Earlier they were not issuing the DL without an ITIN if you do not have SSN; my wife had to wait for almost a year as you cannot apply for ITIN unless you send the W7 with your tax returns due to new regulations. Now they are NOT concerned on ITIN, but are looking for VISA stamp. Only thing that can be done online in NC with regards to DL is you can get a Duplicate DL online if lost or your address is changed. Try writing to Congressman David Price and see if you can get assist from him. I know this office has helped folks here on Visas before for other issues.

more...

priti8888

07-18 06:03 PM

priti8888,

That is not true. Receipt Date is when the service center physically receives the package. They date stamp it and then use it to enter that RD when they generate the Notice on the ND.

What you see on the status page for sure reflects the ND and NOT the RD. So you can pretty much ignore what the status page says and rely on what your physical notice says (it states the actual RD when they physically received the package!)

Hope this is a clear explanation.

Oh really!..then i might be wrong. So RD is before the ND

THANKS Shreekhand

That is not true. Receipt Date is when the service center physically receives the package. They date stamp it and then use it to enter that RD when they generate the Notice on the ND.

What you see on the status page for sure reflects the ND and NOT the RD. So you can pretty much ignore what the status page says and rely on what your physical notice says (it states the actual RD when they physically received the package!)

Hope this is a clear explanation.

Oh really!..then i might be wrong. So RD is before the ND

THANKS Shreekhand

2010 Larry The Cable Guy amp; Bill

anilnag

02-23 02:09 PM

At NSC I am seeing the following entry

-----

I-485 Application to Register Permanent Residence or to Adjust Status Employment-based adjustment applications 4 Months

-----

What does 4 months mean?

It means USCIS has pre-adjudicated your I-485 if it was filed before october 2008.

-----

I-485 Application to Register Permanent Residence or to Adjust Status Employment-based adjustment applications 4 Months

-----

What does 4 months mean?

It means USCIS has pre-adjudicated your I-485 if it was filed before october 2008.

more...

royu

08-23 05:57 PM

Well explained.

Most of EB2 falls into : 1.Advanced Degree-(where most of us fall into ) it is either masters or Bachelors+5 years

Till now there is no proposal to change the above.

The internal memo is for Extraordinary Ability quota, and it is in comment period. It is not implemented yet.

The similar kind of restriction should be applied for EB1 - multinational executive quota.

Most of EB2 falls into : 1.Advanced Degree-(where most of us fall into ) it is either masters or Bachelors+5 years

Till now there is no proposal to change the above.

The internal memo is for Extraordinary Ability quota, and it is in comment period. It is not implemented yet.

The similar kind of restriction should be applied for EB1 - multinational executive quota.

hair larry-cable-guy-man-room

sandy_anand

06-16 12:58 PM

If you are stuck at Atlanta PERM backlog center , please email your case number and explain them that your application has been pending for a LONG time and request them to help us get out of this grave situation. Also, please post on this thread after you have sent an email so that others can be motivated to do the same. We need to send as many emails as possible to get any positive feedback. I know that DOL mentioned that they will start processing our applications soon, but we need to keep up the pressure from our end so that it has some positive effect.

I know most of the people on this forum are not in this situation ..... but let's see how many can come out of this selfishness and help others by emailing / phoning DOL Atlanta to help other brothers who want to file AOS just like them...... When phone campaigns / email campaigns happen .... we who are stuck at Atlanta help others tooo... so let's see how many on this form help us now...

Here is the info :

email : Perm.DFLC@dol.gov

Phone : 404-893-0101

Thanks

Champak (Same as 1 and 2)

Champak, I'm in the same boat as yours. Called the Atlanta number and left a message with my case number. My attorney sent an email this week. I have also asked my employer to do the same. Maybe I'll take your advice and send them an email too.

I know most of the people on this forum are not in this situation ..... but let's see how many can come out of this selfishness and help others by emailing / phoning DOL Atlanta to help other brothers who want to file AOS just like them...... When phone campaigns / email campaigns happen .... we who are stuck at Atlanta help others tooo... so let's see how many on this form help us now...

Here is the info :

email : Perm.DFLC@dol.gov

Phone : 404-893-0101

Thanks

Champak (Same as 1 and 2)

Champak, I'm in the same boat as yours. Called the Atlanta number and left a message with my case number. My attorney sent an email this week. I have also asked my employer to do the same. Maybe I'll take your advice and send them an email too.

more...

indyanguy

08-20 04:52 PM

USCIS_COMPLAINT is an inactive email account should be reported to the Ombudsman as well.

As for management,following are responsible for NSC:-

Director: Gerard Heinauer

Deputy Director: Gregory W. Christian

Yep, my email bounced back as well. Do you happen to have emails for the Director and the Dy. Director?

As for management,following are responsible for NSC:-

Director: Gerard Heinauer

Deputy Director: Gregory W. Christian

Yep, my email bounced back as well. Do you happen to have emails for the Director and the Dy. Director?

hot larry the cable guy delta

Suva

07-15 10:58 AM

Scheduled $5 every month...

more...

house larry cable guy. larry the

nlssubbu

07-24 06:05 PM

this is a 2004 EB3 approval! This is the first one I am seeing from 2004. So looks like they have really cleaned the pipes here, and things should be better going forward.

The nicest thing of this whole fiasco is that they seem to have ignored country-limits and approved as many as possible. Last year they did only 9.8K EB Indians (teh final count was 17k, but that was due to ScheduleA). THis year (2007) if they have gotten 20-30K India applications out, the dates should move better in the future.

Eagerly awaiting 2 USCIS stats:

1. per-country per-category EB approvals in 2007

2. number of 485 applications received by August 17th

Per country quota is not applicable based on AC21 rule when it is current for every one. This is what happened due to the July visa bulletin fiasco. As they are honouring that bulletin, they are also forced to approve across all country

The nicest thing of this whole fiasco is that they seem to have ignored country-limits and approved as many as possible. Last year they did only 9.8K EB Indians (teh final count was 17k, but that was due to ScheduleA). THis year (2007) if they have gotten 20-30K India applications out, the dates should move better in the future.

Eagerly awaiting 2 USCIS stats:

1. per-country per-category EB approvals in 2007

2. number of 485 applications received by August 17th

Per country quota is not applicable based on AC21 rule when it is current for every one. This is what happened due to the July visa bulletin fiasco. As they are honouring that bulletin, they are also forced to approve across all country

tattoo Larry The Cable Guy: Health

santb1975

05-27 02:03 PM

^^^

more...

pictures Larry the Cable Guy Drawing

ramaonline

06-01 04:02 PM

In such cases you need not worry - as the law only kicks in sometime in oct 08 - again the language is not certain until the time the president signs it - More changes are possible in the house if the senate passes it - The conference committee may again change the text

dresses Larry, The Cable Guy

gcfriend65

01-03 12:13 PM

Maybe they are referring to Notice date and not Receipt date.

I checked with NSC today regarding our AP filed on Oct 8th, 2007. I was told that they are processing September 16th right now and it would be few weeks before they get to mine.

Thanks

I checked with NSC today regarding our AP filed on Oct 8th, 2007. I was told that they are processing September 16th right now and it would be few weeks before they get to mine.

Thanks

more...

makeup Larry The Cable Guy

bidhanc

03-11 10:51 AM

I guess it's not a VERY GOOD IDEA THEN.

In all the docs that I went thru I could not see a difference between

"I-140 approved/I-485 pending and porting" and "I-140/I-485 pending and porting" (most docs refer to the latter).

I am guessing when it comes to "porting", both are the same in the eyes of USCIS??

(What I mean to ask is there any leniency with an approved I-140 and then trying to port?)

Anyone see otherwise?

http://www.uscis.gov/files/pressrelease/AC21Intrm122705.pdf

as per this document, you can port to yourself. (Question #8)

But below are the reasons why I am backing off of opening an LLC on spouse name and porting to that.

http://murthyforum.atinfopop.com/4/OpenTopic?a=tpc&s=1024039761&f=4654000912&m=8231099851

also google 'UntanglingSkein_BIB_15jan07.pdf"

http://www.morganlewis.com/pubs/UntanglingSkein_BIB_15jan07.pdf

"This suggests, fairly clearly, that any communication to the USCIS per the Cronin Memo that the adjustment applicant intends to become self-employed is likely to trigger an RFE to inquire into the legitimacy of this arrangement. Legitimacy in this context is likely to be gauged by the concrete steps the beneficiary has taken in furtherance of the self-employment arrangement, understanding that only full-time and permanent employment will suffice for immigration purposes. Such steps would include the completion of legal and corporate formalities, the securing of financing, the purchase or lease of business premises and equipment,the development of a detailed business plan, the hiring of employees, and any other measures typically taken in the establishment of a business. Vague aspirational statements, however ambitious, about future plans to develop a business are unlikely, in the absence of tangible proof, to be accepted as probative of the requisite legitimacy of the self-employer and job offer."

Also, one relevant footnote in the document -

"At the AILA National Conference in 2003, a USCIS officer indicated that an attempt to invoke �106(c) in a selfemployment context is likely to raise �a big red flag� for an adjudicator, and that self-employment may be viewed as �an easy alternative� for aliens who are unable to find employment to sustain their adjustment-of-status applications. Schorr & Yale-Loehr, supra note 2, at 499. It should also be noted that the Memos view the possibility of an adjustment applicant becoming a public charge (and thus being inadmissible under INA �212(a)(4)) as being �a relevant inquiry� and that an RFE requesting information about a self-employment arrangement is likely to probe whether or not the applicant has sufficient financial resources to avoid becoming such a public charge."

In all the docs that I went thru I could not see a difference between

"I-140 approved/I-485 pending and porting" and "I-140/I-485 pending and porting" (most docs refer to the latter).

I am guessing when it comes to "porting", both are the same in the eyes of USCIS??

(What I mean to ask is there any leniency with an approved I-140 and then trying to port?)

Anyone see otherwise?

http://www.uscis.gov/files/pressrelease/AC21Intrm122705.pdf

as per this document, you can port to yourself. (Question #8)

But below are the reasons why I am backing off of opening an LLC on spouse name and porting to that.

http://murthyforum.atinfopop.com/4/OpenTopic?a=tpc&s=1024039761&f=4654000912&m=8231099851

also google 'UntanglingSkein_BIB_15jan07.pdf"

http://www.morganlewis.com/pubs/UntanglingSkein_BIB_15jan07.pdf

"This suggests, fairly clearly, that any communication to the USCIS per the Cronin Memo that the adjustment applicant intends to become self-employed is likely to trigger an RFE to inquire into the legitimacy of this arrangement. Legitimacy in this context is likely to be gauged by the concrete steps the beneficiary has taken in furtherance of the self-employment arrangement, understanding that only full-time and permanent employment will suffice for immigration purposes. Such steps would include the completion of legal and corporate formalities, the securing of financing, the purchase or lease of business premises and equipment,the development of a detailed business plan, the hiring of employees, and any other measures typically taken in the establishment of a business. Vague aspirational statements, however ambitious, about future plans to develop a business are unlikely, in the absence of tangible proof, to be accepted as probative of the requisite legitimacy of the self-employer and job offer."

Also, one relevant footnote in the document -

"At the AILA National Conference in 2003, a USCIS officer indicated that an attempt to invoke �106(c) in a selfemployment context is likely to raise �a big red flag� for an adjudicator, and that self-employment may be viewed as �an easy alternative� for aliens who are unable to find employment to sustain their adjustment-of-status applications. Schorr & Yale-Loehr, supra note 2, at 499. It should also be noted that the Memos view the possibility of an adjustment applicant becoming a public charge (and thus being inadmissible under INA �212(a)(4)) as being �a relevant inquiry� and that an RFE requesting information about a self-employment arrangement is likely to probe whether or not the applicant has sufficient financial resources to avoid becoming such a public charge."

girlfriend Larry the cable guy.

iambest

09-11 07:01 PM

I am in!!

hairstyles Larry the Cable Guy

Suva

07-19 02:30 PM

I think you are wrong. When the application is entered into the system that date is called Notice date. Receipt date would be the date USCIS recieves the application.

Receipt date is not the date when the application reaches the service center. It is infact the date when your application is entered into their internal system which could be several days after the application has reached the service center.

Receipt date is not the date when the application reaches the service center. It is infact the date when your application is entered into their internal system which could be several days after the application has reached the service center.

harivenkat

08-12 11:37 AM

Just dont get what the senator is intending here ....

"The business model of these newer companies is not to make any new products or technologies like Microsoft or Apple does. Instead, their business model is to bring foreign tech workers into the United States who are willing to accept less pay than their American counterparts, place these workers into other companies in exchange for a �consulting fee,� and transfer these workers from company to company in order to maximize profits from placement fees. In other words, these companies are petitioning for foreign workers simply to then turn around and provide these same workers to other companies who need cheap labor for various short term projects."

Does this mean every H1b at MS, Apple invents ipod, iphone, USB etc.... and there is no similarity in the nature of work done by him compared to that coming from a consulting company at a client site..... he talks about products or technologies but what about services/speciality occupation using these products/technologies ... that is exactly what most of the IT sector does....

"The H-1B is a non-immigrant visa in the United States under the Immigration and Nationality Act, section 101(a)(15)(H). It allows U.S. employers to temporarily employ foreign workers in specialty occupations."

Not sure if senator is missing it or dodging it ....

"The business model of these newer companies is not to make any new products or technologies like Microsoft or Apple does. Instead, their business model is to bring foreign tech workers into the United States who are willing to accept less pay than their American counterparts, place these workers into other companies in exchange for a �consulting fee,� and transfer these workers from company to company in order to maximize profits from placement fees. In other words, these companies are petitioning for foreign workers simply to then turn around and provide these same workers to other companies who need cheap labor for various short term projects."

Does this mean every H1b at MS, Apple invents ipod, iphone, USB etc.... and there is no similarity in the nature of work done by him compared to that coming from a consulting company at a client site..... he talks about products or technologies but what about services/speciality occupation using these products/technologies ... that is exactly what most of the IT sector does....

"The H-1B is a non-immigrant visa in the United States under the Immigration and Nationality Act, section 101(a)(15)(H). It allows U.S. employers to temporarily employ foreign workers in specialty occupations."

Not sure if senator is missing it or dodging it ....

crazy_gc

07-21 06:45 AM

dont know about how many they are processing right now but in 2004 this is how many they were processing.

"The USCIS currently produces approximately 24,000 EADs per week."

https://www.visanow.com/IMMIGRATION_VISA_INFORMATION/visanownewsletter/2004/06/June2004Voice.html

"The USCIS currently produces approximately 24,000 EADs per week."

https://www.visanow.com/IMMIGRATION_VISA_INFORMATION/visanownewsletter/2004/06/June2004Voice.html

No comments:

Post a Comment